Delving into Share Market Corrections vs. Crashes: Know the Difference, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the nuances between share market corrections and crashes, we uncover the key distinctions that investors need to grasp for informed decision-making in the financial realm.

Understanding Share Market Corrections

Share market corrections are temporary declines in the value of the stock market, typically ranging from 10% to 20% from recent highs. These corrections are a natural part of the market cycle and are considered healthy adjustments after periods of rapid growth.

Causes of Share Market Corrections

- Economic Indicators: Changes in economic indicators such as GDP growth, inflation rates, or employment numbers can trigger a market correction.

- Interest Rates: Rising interest rates can lead investors to sell off stocks, causing a market correction.

- Market Speculation: Overvalued stocks due to speculation can result in a correction when the bubble bursts.

Examples of Historical Share Market Corrections

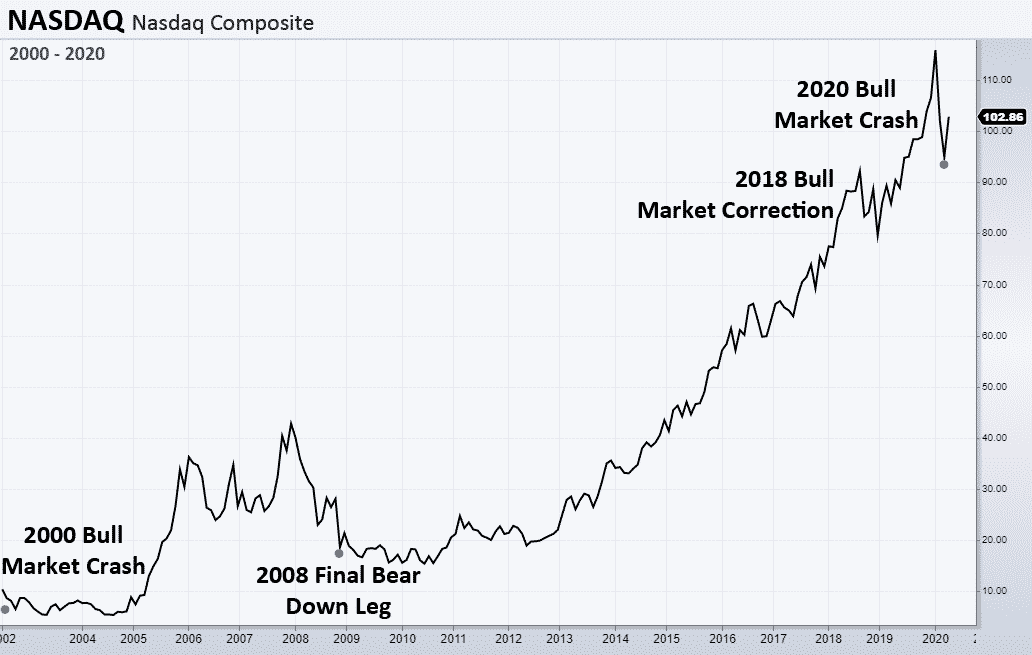

- The Dot-Com Bubble Burst (2000): The rapid rise and subsequent crash of internet-related stocks led to a significant market correction.

- Global Financial Crisis (2008): The housing market collapse in the United States triggered a widespread market correction around the world.

- COVID-19 Pandemic (2020): The uncertainty and economic impact of the pandemic caused a sharp market correction in early 2020.

Recognizing Share Market Crashes

Share market crashes are sudden and severe declines in the value of stocks or other financial assets traded in the market. They are characterized by a rapid drop in prices across a wide range of securities, often resulting in panic selling by investors.These crashes have a significant impact on both individual investors and the overall economy.

Investors may experience substantial losses in their portfolios, leading to a decrease in wealth and confidence in the market. The economy can also suffer as businesses may struggle with declining stock prices, reduced consumer spending, and potential job losses.

Distinguishing Characteristics

- Share market crashes typically involve a sharp and steep decline in stock prices over a short period, leading to widespread financial turmoil.

- Investor sentiment during a crash is characterized by fear, panic, and a rush to sell assets at any price, exacerbating the downward spiral.

- Crashes often have a more profound and long-lasting impact on the market compared to corrections, with the potential to trigger a broader economic downturn.

Differences in Magnitude and Duration

When it comes to share market corrections versus crashes, one key aspect that sets them apart is the differences in magnitude and duration.Share Market Correction:A correction in the stock market typically involves a decline of around 10% or less from recent highs.

While corrections can cause some panic among investors, they are generally considered a healthy and normal part of market cycles.Share Market Crash:On the other hand, a crash is characterized by a sharp and severe decline of 20% or more from recent highs.

Crashes often happen suddenly and can lead to widespread fear and uncertainty among investors.

Magnitude Comparison

- Correction: Usually a decline of around 10% or less.

- Crash: Involves a sharp decline of 20% or more.

Duration Comparison

- Correction: Typically lasts for a few weeks to a couple of months.

- Crash: Can happen within a few days or weeks, with recovery potentially taking months or even years.

It's important to note that these figures are general guidelines and can vary depending on the specific market conditions and factors at play. Understanding these differences can help investors better navigate the ups and downs of the stock market.

Investor Strategies During Corrections and Crashes

Investors often employ different strategies to navigate through market corrections and crashes, as these periods of volatility can have a significant impact on their investment portfolios.

Common Strategies for Investors During Market Corrections

During market corrections, where there is a decline of at least 10% from recent highs, investors typically rely on the following strategies:

- Stay the course: Many investors choose to stay invested and ride out the market turbulence, believing that the correction is a temporary setback.

- Buy the dip: Some investors see market corrections as buying opportunities and may choose to purchase more shares at lower prices.

- Diversification: Investors may review their portfolio diversification to ensure they are not overly exposed to a particular sector or asset class.

Investor Behavior During a Market Crash

When a market experiences a crash, characterized by a sudden and severe decline of 20% or more, investor behavior tends to be more extreme:

- Panic selling: Fear and uncertainty can lead to panic selling, as investors rush to liquidate their holdings to minimize losses.

- Seeking safe havens: Investors may flock to safe-haven assets such as gold or government bonds to protect their capital during a market crash.

- Market timing: Some investors may attempt to time the market by selling before the crash worsens or buying back in at what they perceive as the bottom.

It's essential for investors to remain calm and rational during both corrections and crashes to make well-informed decisions that align with their long-term financial goals.

Last Recap

Wrapping up our discussion on Share Market Corrections vs. Crashes: Know the Difference, we have dissected the complexities of market fluctuations, equipping you with a deeper understanding of how to navigate turbulent financial waters with confidence.

Detailed FAQs

What is the main difference between a market correction and a market crash?

A share market correction is typically a 10% decline from recent highs, whereas a crash is a sudden and severe drop of 20% or more in a short period.

How should investors approach market corrections versus market crashes?

During corrections, it's often a good time to reassess your portfolio and potentially buy undervalued assets. In crashes, preserving capital and avoiding panic selling are crucial.

Are there any warning signs that precede a market crash?

Some warning signs include excessive market speculation, high levels of debt, and overvaluation of assets, though predicting crashes with certainty is challenging.

How long do market corrections typically last compared to market crashes?

Market corrections tend to be shorter in duration, usually lasting weeks to a few months, while market crashes can have longer-lasting impacts, taking months to years to recover.