Exploring the world of investing can be overwhelming, especially when faced with the decision between micro and blue-chip shares. This comparison delves into the nuances of both types of shares, offering insights to help you make informed decisions for your portfolio.

As we navigate through the complexities of market capitalization, risk factors, and performance trends, you'll discover the key differences and similarities that can impact your investment strategy.

Micro vs. Blue-Chip Shares Overview

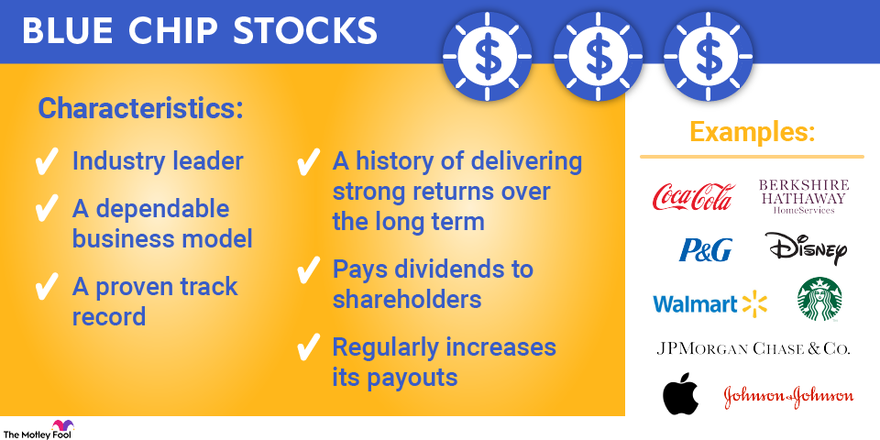

Micro shares and blue-chip shares represent two ends of the spectrum in the stock market. Micro shares are stocks of small companies with a market capitalization typically under $300 million. On the other hand, blue-chip shares are stocks of large, stable, and well-established companies with a market capitalization typically exceeding $10 billion.

Market Capitalization and Risk

Micro shares are considered riskier investments due to the volatility associated with small companies. These companies may have limited resources, lower liquidity, and higher susceptibility to market fluctuations. On the contrary, blue-chip shares are known for their stability, strong financial positions, and consistent dividend payments.

They are less volatile and often considered safer investments.

- Micro shares have the potential for high returns but come with a higher risk of loss.

- Blue-chip shares offer more stability and lower risk but may provide lower returns compared to micro shares.

Examples of Companies

- Micro Shares:XYZ Biotech, a small pharmaceutical startup with innovative products but limited market presence.

- Blue-Chip Shares:ABC Corp, a multinational conglomerate with a long history of success and a diverse portfolio of products and services.

Factors to Consider

When deciding between micro and blue-chip shares for your portfolio, there are several key factors to take into consideration. These factors include your investment goals, risk tolerance, and time horizon. Each type of share aligns differently with various investment strategies, so it's crucial to understand how they may impact your portfolio.

Additionally, market conditions play a significant role in the performance of micro and blue-chip shares, so staying informed about the market environment is essential.

Investment Goals, Risk Tolerance, and Time Horizon

- Investment Goals: Consider whether you are looking for long-term growth or short-term gains. Blue-chip shares are typically more stable and suited for long-term investors seeking consistent returns, while micro shares can offer higher growth potential but come with increased volatility.

- Risk Tolerance: Evaluate how comfortable you are with fluctuations in the market. Micro shares are riskier due to their smaller size and lack of established track record, making them more suitable for investors with a higher risk tolerance. Blue-chip shares, on the other hand, are less volatile and provide a sense of security for more risk-averse investors.

- Time Horizon: Determine how long you plan to hold onto your investments. Micro shares may require a longer time horizon to realize their full growth potential, whereas blue-chip shares can provide more immediate returns for investors with a shorter time frame.

Alignment with Investment Strategies

- Value Investing: Blue-chip shares are often favored by value investors looking for stable companies with strong fundamentals trading at a discount. Micro shares may not always align with this strategy as they are more focused on growth potential rather than intrinsic value.

- Growth Investing: Micro shares are commonly associated with growth investing, as they have the potential for rapid expansion and significant returns. Blue-chip shares may not offer the same level of growth opportunities but provide steady and reliable performance over time.

Impact of Market Conditions

- Market Conditions: Market volatility can affect both micro and blue-chip shares differently. Micro shares are more susceptible to market fluctuations due to their smaller size and lower liquidity, while blue-chip shares tend to be more resilient during turbulent market periods.

- Industry Trends: Changes in industry trends can impact the performance of micro and blue-chip shares. Micro shares in emerging industries may experience rapid growth but also face higher risks, whereas blue-chip shares in established sectors offer stability but may have limited growth potential.

Risk and Return Analysis

When it comes to investing in the stock market, understanding the risk-return profile of different types of shares is crucial for building a well-balanced portfolio. Let's delve into how micro shares stack up against blue-chip shares in terms of risk and potential returns.

Risk Comparison

- Micro shares are known for their high volatility, which means prices can fluctuate significantly in a short period. This volatility exposes investors to higher risks as the value of their investment can drop suddenly.

- On the other hand, blue-chip shares are considered less volatile and more stable. These companies are well-established, financially sound, and less susceptible to market fluctuations, making them a lower-risk investment option.

Return Comparison

- Micro shares have the potential to offer high returns, especially if the company experiences rapid growth or a sudden increase in stock price. However, these high returns come with higher risks due to the volatile nature of micro-cap companies.

- Blue-chip shares may provide more modest returns compared to micro shares, but they offer a higher level of stability and consistency. Investors often rely on blue-chip stocks for long-term growth and dividend income.

Balancing Risk and Return

- Investors can balance risk and return by diversifying their portfolio with a mix of micro and blue-chip shares. Allocating a portion of funds to higher-risk micro shares can potentially boost overall returns, while investing in blue-chip shares can provide stability and lower the overall risk of the portfolio.

- It's essential for investors to assess their risk tolerance, investment goals, and time horizon when deciding on the allocation between micro and blue-chip shares. A well-balanced portfolio that considers both risk and return can help investors achieve their financial objectives while managing market volatility.

Market Performance and Trends

Market performance and trends play a crucial role in determining the success of investments in both micro and blue-chip shares. Let's delve into the historical performance trends of these shares and how various factors impact their performance.

Historical Performance Trends

When looking at historical performance trends, it's important to note that micro shares tend to be more volatile, with the potential for higher returns but also higher risks. On the other hand, blue-chip shares are known for their stability and consistent returns over time.

Investors often choose between these two types of shares based on their risk tolerance and investment goals.

Market Dynamics and Economic Conditions

Market dynamics and economic conditions greatly influence the performance of both micro and blue-chip shares. For micro shares, these shares are more susceptible to market fluctuations and economic downturns due to their smaller size and exposure. Blue-chip shares, on the other hand, are usually less affected by short-term market trends and economic conditions, making them a safer option during turbulent times.

Industry Trends Impact

Industry trends also play a significant role in the performance of micro and blue-chip shares. Micro shares are often found in emerging industries or niche sectors, which can lead to rapid growth but also higher volatility. Blue-chip shares, on the other hand, are typically found in established industries with stable growth prospects, providing more security for investors.

Potential Opportunities and Challenges

Investors in micro shares have the opportunity to capitalize on high-growth potential and see substantial returns if they choose the right companies. However, the challenge lies in managing the higher risks associated with these shares. On the other hand, investing in blue-chip shares offers stability and consistent returns, but the trade-off may be lower growth potential compared to micro shares.

Wrap-Up

In conclusion, understanding the dynamics between micro and blue-chip shares is crucial in shaping a well-balanced portfolio. By weighing the various factors discussed, investors can tailor their investment approach to align with their financial goals and risk tolerance.

FAQ Guide

What are micro shares and blue-chip shares?

Micro shares refer to stocks of small companies with low market capitalization, while blue-chip shares are stocks of large, established companies with a history of stable performance.

How do market conditions affect micro and blue-chip shares?

Market conditions can impact the performance of both types of shares differently. Micro shares tend to be more volatile and sensitive to market fluctuations, while blue-chip shares are often more resilient during turbulent times.

Which factors should investors consider when choosing between micro and blue-chip shares?

Investors should assess their investment goals, risk tolerance, and time horizon before deciding on micro or blue-chip shares. Micro shares offer higher growth potential but come with increased risk, whereas blue-chip shares provide stability but may have lower growth prospects.