When it comes to securing your financial future, choosing the right stocks for your retirement portfolio is crucial. In this comprehensive guide, we will delve into the intricacies of selecting the best stocks that will help you build a solid foundation for your retirement savings.

From understanding the key characteristics of top-performing stocks to exploring the importance of diversification and risk management, this guide will equip you with the knowledge needed to make informed decisions for your retirement investments.

Understanding Retirement Portfolios

A retirement portfolio is a collection of investments specifically tailored to provide income and financial security during retirement years. It is crucial for individuals to build a retirement portfolio to ensure a comfortable and stable financial future.

Choosing the best stocks for retirement portfolios is essential to achieve long-term growth and stability. Stocks play a vital role in retirement portfolios as they have the potential to generate substantial returns over time, helping individuals build wealth for their retirement years.

Key Considerations when Choosing Stocks for Retirement Portfolios

- Diversification: It is important to diversify your stock holdings to reduce risk. Investing in a mix of different sectors and industries can help protect your portfolio from market fluctuations.

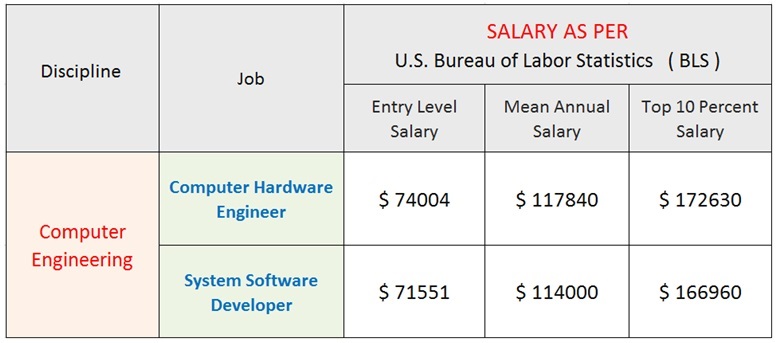

- Dividend-Paying Stocks: Consider adding dividend-paying stocks to your portfolio, as they can provide a steady income stream during retirement.

- Long-Term Growth Potential: Look for stocks with strong fundamentals and long-term growth potential. These stocks can help your portfolio grow steadily over time.

- Risk Tolerance: Assess your risk tolerance and invest in stocks that align with your investment goals and comfort level. It's important to balance risk and return in your retirement portfolio.

- Costs and Fees: Be mindful of costs and fees associated with buying and selling stocks. Minimizing expenses can help maximize your overall returns in the long run.

Characteristics of the Best Stocks

When selecting stocks for a retirement portfolio, certain characteristics are essential to ensure long-term growth and stability. Here are some key factors to consider:

Diversification

Diversification is a crucial concept in building a retirement portfolio. By investing in a variety of stocks across different sectors and industries, you can reduce the overall risk in your portfolio. This means that if one stock or sector underperforms, the impact on your overall portfolio will be minimized.

Diversification helps to spread out risk and increase the chances of overall portfolio growth.

Risk Factors

When choosing stocks for a retirement portfolio, it's important to consider various risk factors. These can include market risk, company-specific risk, and economic risk. Market risk refers to the overall volatility of the stock market, which can impact the value of your investments.

Company-specific risk relates to factors that are specific to a particular company, such as poor management decisions or product failures. Economic risk encompasses broader economic factors that can affect the performance of stocks, such as interest rates, inflation, and global economic conditions.

It's important to assess these risk factors and choose stocks that align with your risk tolerance and long-term financial goals.

Research and Analysis

When it comes to building a retirement portfolio with the best stocks, thorough research and analysis are key. This involves studying various factors to make informed decisions that align with your long-term financial goals.

Identifying the Best Stocks

- Start by looking at the company's financial health, including revenue growth, profitability, and debt levels.

- Consider the industry trends and competitive landscape to assess the company's position in the market.

- Analyze the company's management team and their track record of success in navigating challenges.

- Review analyst reports and ratings to gauge market sentiment and expectations for the stock.

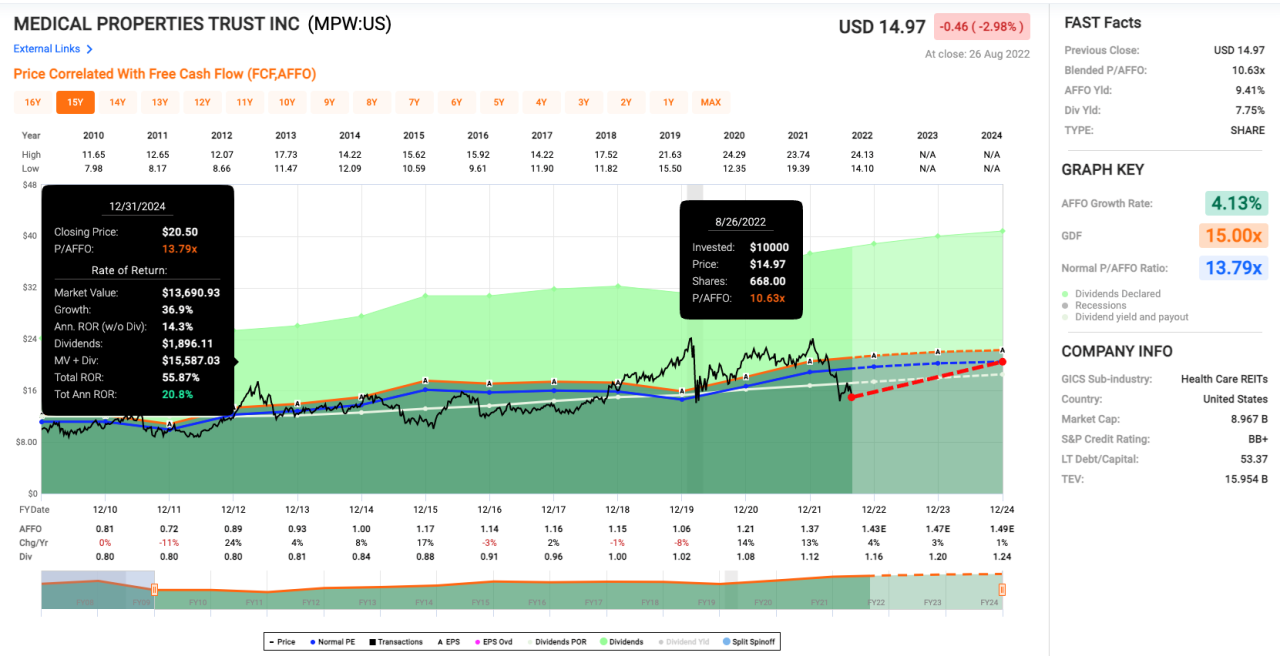

Analyzing Historical Performance Data

- Examine the stock's historical price movements, looking for patterns or trends that could indicate future performance.

- Analyze key financial ratios such as price-to-earnings ratio, return on equity, and dividend yield to assess the stock's valuation and growth potential.

- Compare the stock's performance to relevant benchmarks or indices to evaluate its relative strength and performance.

- Consider any major events or news that may have impacted the stock's price and performance in the past.

Importance of Staying Updated on Market Trends

- Regularly monitor financial news and market updates to stay informed about macroeconomic factors that could influence stock prices.

- Stay updated on company-specific news and announcements that may impact the stock's performance in the short or long term.

- Keep track of industry trends and regulatory changes that could affect the company's operations and growth prospects.

- Utilize tools and resources such as stock screeners, financial websites, and investment newsletters to stay abreast of relevant information.

Building a Diversified Portfolio

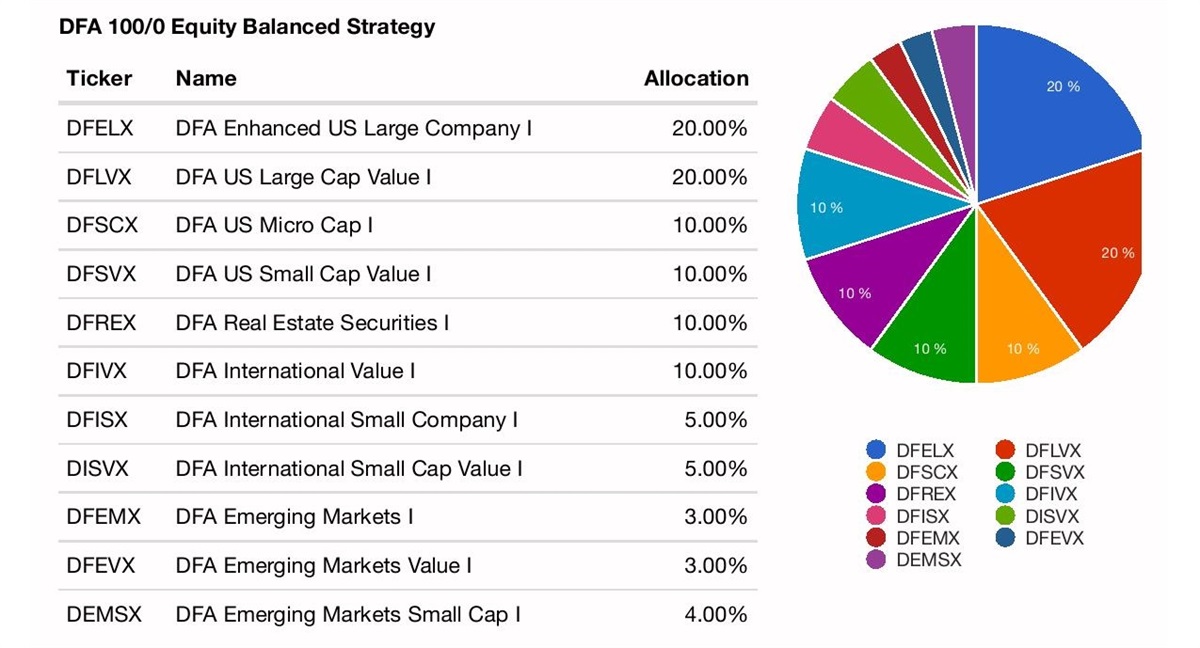

Building a diversified portfolio is crucial for retirement planning as it helps spread risk and maximize returns over the long term. By investing in various stocks across different sectors and industries, you can mitigate the impact of market fluctuations on your overall portfolio.

Importance of Asset Allocation

Asset allocation plays a key role in building a diversified portfolio for retirement. It involves dividing your investments among different asset classes such as stocks, bonds, and cash equivalents based on your risk tolerance, time horizon, and financial goals. By allocating your assets strategically, you can manage risk and potentially enhance returns.

- Allocate assets based on your risk tolerance: Consider how much risk you are willing to take and adjust your asset allocation accordingly. Typically, younger investors can afford to take on more risk by investing a larger portion in stocks, while older investors may lean towards more conservative investments.

- Diversify across sectors and industries: Invest in stocks from various sectors such as technology, healthcare, consumer goods, and finance to minimize sector-specific risks. A well-diversified portfolio can help cushion the impact of a downturn in any particular sector.

- Rebalance regularly: Periodically review and rebalance your portfolio to ensure that your asset allocation aligns with your investment goals. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired allocation.

Risk Management in a Diversified Stock Portfolio

Risk management is essential when building a diversified stock portfolio for retirement. It involves assessing and mitigating various risks to protect your investments and achieve long-term growth.

- Understand your risk tolerance: Determine how much risk you are comfortable with and tailor your investment choices accordingly. Consider factors such as age, financial goals, and time horizon when assessing your risk tolerance.

- Use diversification to reduce risk: Spread your investments across different stocks, sectors, and asset classes to minimize the impact of market volatility on your portfolio. Diversification can help smooth out fluctuations and protect your investments from significant losses.

- Implement stop-loss orders: Consider using stop-loss orders to limit potential losses on individual stocks. Set a predetermined price at which you are willing to sell a stock to prevent further decline in its value.

Closing Summary

In conclusion, navigating the world of retirement portfolios can seem daunting, but armed with the right information and strategies, you can set yourself up for a financially secure future. By carefully selecting the best stocks and staying informed about market trends, you can optimize your retirement portfolio for long-term success.

Quick FAQs

What are the key considerations when choosing stocks for retirement portfolios?

Key considerations include the company's financial stability, growth potential, dividend history, and industry trends.

How can I analyze historical performance data of stocks for retirement portfolios?

You can use tools like stock charts and financial websites to track a stock's historical performance over different time frames.

Why is asset allocation important in retirement portfolios?

Asset allocation helps spread risk across different types of investments, reducing the impact of market fluctuations on your overall portfolio.